In a post global financial crisis world, how is New Zealand tracking?

In a post global financial crisis world, how is New Zealand tracking?

Is there an underbelly of underperforming companies? Do we have a zombie problem and if so are they haunting the economy?

To help answer these questions, KPMG conducted a survey across New Zealand’s major banks and lending institutions over the last few months. It has shown some interesting trends and revealed insights into the mind-set of lenders across the country.

Given the fact that lenders were asked questions around their ‘average’ size clients, we believe the sample of approximately 200 survey recipients represents a consistent cross section of ‘New Zealand Inc.’

Lenders are concerned about ‘zombie’ companies that lack the cash flow and profits to pay down the debt on their balance sheets.

With questionable viability, these businesses are a focus area for the health of the economy, and lenders do not believe that the problems are going away soon.

High-profile business failures are always shocking events but the headlines and analysis that inevitably follow the collapse of a Whitcoulls, BBQ factory or Crafar Farms provide only a partial picture of the economic threats that lie ahead.

Low insolvency

However, New Zealand’s insolvency figures have remained relatively low compared to other economies, suggesting that despite challenging economic conditions, a majority of businesses have successfully weathered the storm.

However, New Zealand’s insolvency figures have remained relatively low compared to other economies, suggesting that despite challenging economic conditions, a majority of businesses have successfully weathered the storm.

But lower insolvencies do not necessarily mean that corporate New Zealand is in good health. Our Report (accompanying our Survey) reveals that financial institutions are concerned about the so-called zombie companies.

Such businesses are living a ‘hand-to-mouth’ existence, generating sufficient cash to carry on trading and paying their bills, however their poor financial position and low levels of operational net cash flows render them unable to repay borrowings.

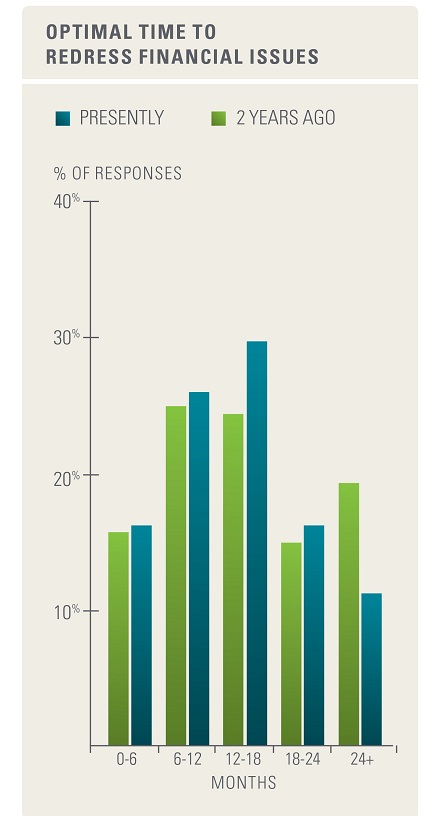

Unless acceptable restructuring solutions can be identified, the Survey suggests that these zombies are here to stay for the medium to long term, assuming that the status quo is allowed to continue by their primary lenders.

Just as the zombies of myth and legend are dead but still walking, the corporate equivalent exists just above outright insolvency but well short of true viability.

ICU companies

Broadly speaking, a zombie is a business in intensive care, requiring on-going financial support and unproductive ‘management’ time from lenders and investors in order to continue trading.

Zombies are not necessarily loss making.

Typically, they will be breaking even or even generating a small profit.

However, while they have sufficient revenues to meet operational expenditure, they are not in a position to repay debt.

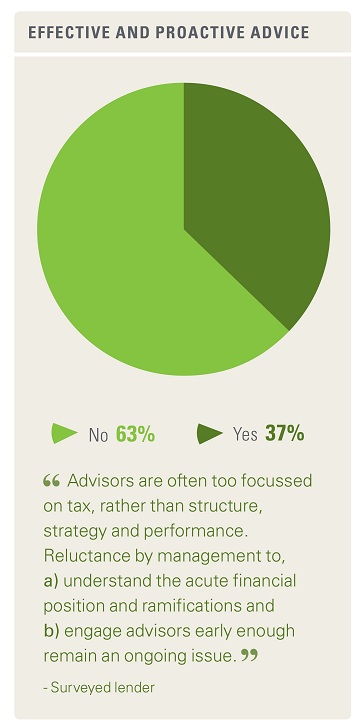

Aware of the unease amongst lenders, we canvassed their opinions on the zombie problem.

The results showed that while the zombie problem is not severe overall, there is a definite polarising of opinion amongst lenders; for some, the zombie problem is haunting. It is not so for others, with very few lenders inhabiting the middle ground.

Case for review

With the Survey revealing expectations of increased zombie exit activity in the short term, would it be appropriate for those lenders who say that zombie companies are not an issue to re-examine their portfolios?

With the Survey revealing expectations of increased zombie exit activity in the short term, would it be appropriate for those lenders who say that zombie companies are not an issue to re-examine their portfolios?

Most zombie businesses were identified as having turnover of $3 million to $20 million, with a lack of credit being more acute for the larger organisations.

Maybe this is symptomatic of margins for all being tight across the board.

Shaun Adams is Head of Restructuring & Insolvency Services at KPMG based in Auckland. The above article, extracted and modified from his recent study titled, ‘Zombie Companies: Are they haunting the economy?’ will appear in three parts.

KPMG is the Sponsor of the ‘Business Excellence in ICT’ of Indian Newslink Indian Business Awards