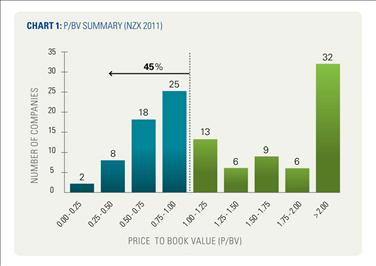

KPMG research shows that 45% of NZX listed companies are trading below the book value in their accounts, in some cases significantly so.

KPMG research shows that 45% of NZX listed companies are trading below the book value in their accounts, in some cases significantly so.

The implication is that the market considers just under half the companies trading on the NZX are valued less than their balance sheets would suggest.

Historically, the market has largely disregarded balance sheets as relevant to value, as they represented a ‘historical ‘point in time view of a company’s financial position.

However, with fair value now firmly entrenched in financial reporting standards, there is greater insight into the true value of certain assets.

Accounting standards require company management to test book values of assets for impairment on a regular basis. Boards of directors have become increasingly familiar with impairment analysis over the last three years and many companies have recorded impairments to asset values.

KPMG believes that while most apparent where the Price to Book Value (P/BV) is less than 1, all companies must develop their own internal view of value and be alert to differences between internal and external viewpoints. They should understand the drivers of such differences and focus on closing the gap where possible.

Constraining factors

A lack of liquidity is often identified as one of the key reasons for stock prices trailing internal value assessments in New Zealand. The consensus is that many stocks do not trade frequently to provide meaningful insight into value.

There are other factors contributing to Value Gap.

The price of some stocks can be influenced by shareholder configuration such as the presence of a cornerstone shareholder with a strategic agenda. This may cause uncertainty and speculation on the future direction of a company and the impact on smaller minority shareholders.

Smaller companies can sometimes trade below fair value because of the disproportionate impact of maintaining a listing and having to face the same compliance costs that larger companies are better able to absorb.

The impact of the Global Financial Crisis cannot be ignored as the equivalent data in 2007 showed only 21% of NZX companies with a P/BV of less than 1.

Global Village

The Global Financial Crisis demonstrated the inter-connectivity of different markets and different industry sectors. What happens in Greece, impacts values in New Zealand and hence understanding this dynamic makes investors nervous and craving for better data to make informed investment decisions.

The analyst community regularly evaluates companies by reference, not only to an understanding of industry fundamentals but also to perceptions of how well company management is addressing and responding to uncertainty.

Some companies are choosing to be proactive in their market communications beyond standard investor relations management. They achieve this by improving analytical tools (including internal valuation models) to understand how shocks to the economic environment will influence their financial performance and business strategy.

Taking this approach allows companies to react quickly to market dynamics and engage with investors on fast changing external and internal developments.

Such an approach will connect well with the forthcoming financial reporting requirements (IFRS 13), where additional disclosure will put key fair value assumptions under the spotlight.

Alternatively, companies may review portfolios and look to dispose of non-core or under-performing operations.

By communicating this approach to the market, they would demonstrate active balance sheet management and the drive to increase shareholder returns.

The above article, sent by Chandan Ohri IT Advisory Partner at KPMG New Zealand has been edited for space reasons. KPMG is the Sponsor of the ‘Business Excellence in ICT’ Category’ of the Indian Newslink Indian Business Awards 2012.