Prime Minister John Key and Finance Minister Bill English clearly signalled a Budget with no major surprises, and that is what they delivered on May 15, 2014.

Budget 2014 continues a steady track of careful fiscal management.

What is encouraging is how strongly the economy is forecast to grow. The return to surplus fulfils a critical political commitment that the Government made, and the forecast for later years of rising surpluses being applied in part to reducing public debt is welcome.

New Zealand is not yet out of the fiscal woods and the Government is keeping a very disciplined approach to the country’s finances.

But the forecast growth in tax revenues has allowed the Government to make increased expenditure commitments to health, education, social services, infrastructure and better public services.

Propensity to spend

Mr English has also indicated larger capacity to spend (or reduce taxes) from next year.

Making these investments pay off will be key for the coming few years to ensure a strong and prosperous New Zealand.

While the economy looks robust in comparison to that of other OECD countries, there is still a balancing act for the next few years.

The housing market, interest rates and exchange rates and the level of private debt mean that many of the pressures that we have felt in the last few years remain as risks to growth.

Businesses should retain a relentless focus on export diversification, productivity growth and innovation. The Government should support that by providing fiscal stability and sound regulatory regimes.

The coming years have real promise for New Zealand if we maintain our focus.

Two surprises

Despite carefully managed pre-Budget expectations, Budget 2014 has delivered two surprises: a surplus of $372 million in 2015, significantly higher than the wafer thin surplus expected; and when taken over a four-year period, higher planned new spending in health, education and welfare than was expected.

The higher surplus, despite extra spending, comes as a result of a forecast of strong economic growth of 3% in 2015 rising to 4% in 2016.

On the back of the strong economy, the Government has announced that it will increase new spending in future budgets by around $1.5 billion a year, half a billion dollars a year more than the 2014 budget allowance of $1 billion.

Rising surplus

Budget 2014 forecasts rising surpluses over the next four years reaching $3.5 billion in 2018.

Budget 2014 forecasts rising surpluses over the next four years reaching $3.5 billion in 2018.

These surpluses are committed to future capital and infrastructure expenditure.

Net debt peaks at $65 billion and then is held at that level, while the economy grows.

As a result, net debt is forecast to reduce to the Government’s target of 20% of GDP by 2020.

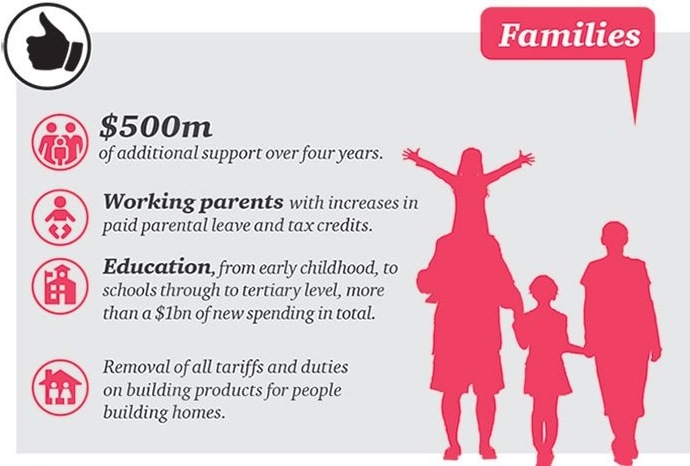

A range of areas have benefited from extra Government spending. Children and families have been a real target. As widely predicted, paid parental leave has been extended to 16 and then 18 weeks, and the parental tax credit has been increased to $220 a week.

Free GP visits and prescriptions have been extended to children up to 13 and more funding provided for early childhood centres.

Health & Education

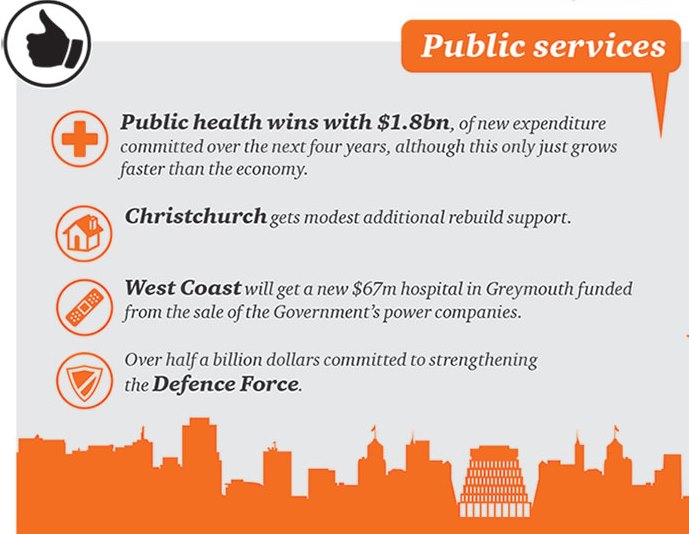

Health receives $1.8 billion of extra funding over the next four years in an attempt to feed our insatiable appetite for health services.

Health receives $1.8 billion of extra funding over the next four years in an attempt to feed our insatiable appetite for health services.

Critical to our long-term future as a nation, education receives a range of extra support from $359 million to fund the Prime Minister’s ‘Super Principal/Teacher Programme,’ to an extra $199 million more invested in tertiary education.

Three new Centres of Research (CORE) Excellence will be established bringing the total to ten. Encouraging innovation through R&D is a theme that runs through Budget 2014 with measures such as the new CORE more contestable science and innovation funding and modest tax relief for R&D companies.

Auckland boost

Auckland infrastructure gets another boost with $375 million of additional capital funding for the New Zealand Transport Agency, which will accelerate new projects valued at $815 million Another $1 billion of the funds raised from the State-Owned Enterprises floats was committed to various capital projects including schools, hospitals and KiwiRail.

The forecast projections show a reduction in the relative size of expenditure on the public service, which will keep the discipline on ‘reprioritisation’ of expenditure to fund new initiatives.

As expected, there was no softening of the Prime Minister’s political commitment to universal national superannuation from the age of 65.

Balance struck

Overall, Budget 2014 tries to strike a balance between returning to sustainable surpluses, allowing some more spending on key areas of need, and providing the fiscal backdrop to support economic growth.

We think it largely achieves that balance.

Bruce R Hassall is Chief Executive and Senior Partner of PricewaterhouseCoopers (PwC) New Zealand based in Auckland.