It is digital to the rescue with more dollars from online consumer and advertising revenue forecast to offset a declining spend on traditional entertainment and media content.

It is digital to the rescue with more dollars from online consumer and advertising revenue forecast to offset a declining spend on traditional entertainment and media content.

This is one finding from a PricewaterhouseCoopers (PwC) study titled, ‘Global entertainment and media outlook 2014-2018.’

Indeed, New Zealand’s total entertainment and media spending on digital is forecast to grow at more than 10% year-on-year between 2014 and 2018, while spending on non- digital content will decline by an average half a per cent every year over the same period.

The figures speak for themselves: the digital journey is over and we are now in the age of the digital normal.

New Zealanders no longer think about whether content is digital or not and neither should entertainment and media businesses. The world has changed and New Zealand businesses should move faster with it and figure out how to make more money from consumers and advertisers.

Digital strategy

This means stepping up from a digital strategy to a business strategy tailored to the realities of the digital age. Businesses must look beyond digital and be more innovative and responsive to the ways people wish to consume content, with a focus on getting to know and engaging people as individuals.

PwC forecasts show digital revenues will account for 110% of total revenue growth over the next five years, with nearly 28% of all advertising revenues and 18% of consumer revenues increasing to be digitally sourced by 2018.

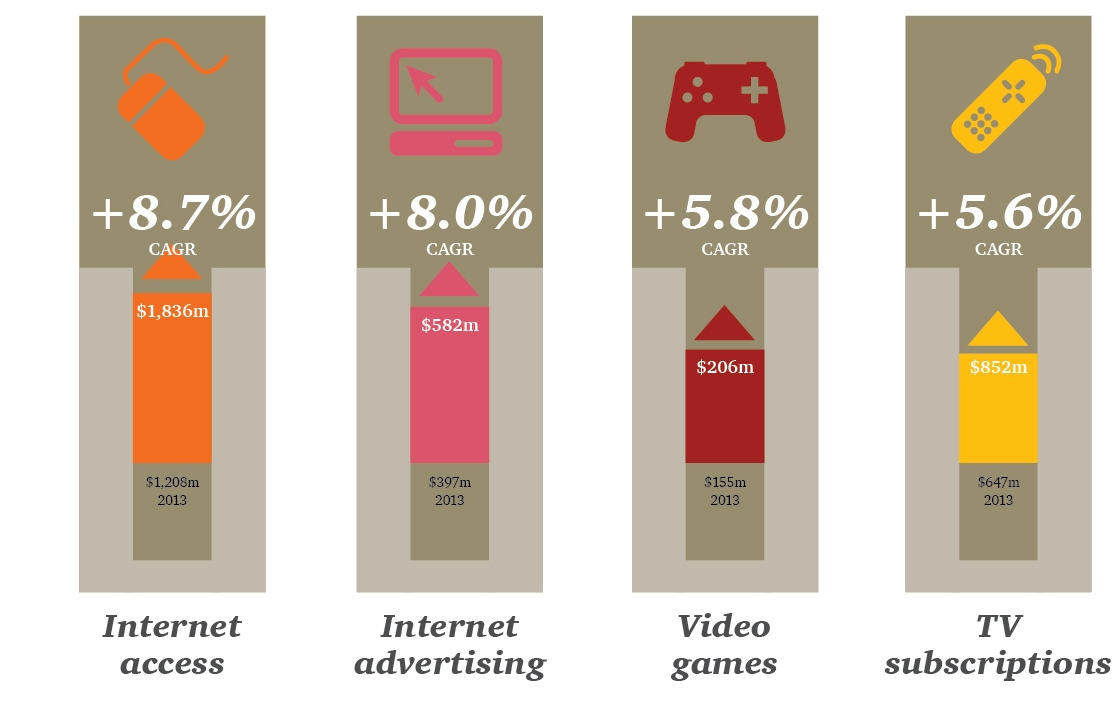

All signs point to digital revenue growth, but spending on digitally delivered content by consumers will continue to play catch-up to the share of spend on internet advertising, which is outpacing the rest of New Zealand’s advertising market.

With internet advertising forecast to grow at an average of 8% year-on-year, it is reaching a significant tipping point and is expected to overtake TV in taking the biggest share of advertising spend in 2018.

Convincing customers

The biggest challenge and opportunity is to monetise the digital consumer by convincing them to pay for content they may currently be getting free or at low cost, while finding new ways to sell and price content and experiences that they would be happy to pay.

For example, selling services where consumers pay for round-the-clock digital access, such as digital music streaming, or selling through micro-transactions.

The report points to a surge in the number of New Zealanders with a smartphone, which now makes up 63% of the mobile phone market, forecast to increase to 74% by 2018.

The biggest annual growth rates in internet advertising were seen in mobile and online video. While this is from a low base, it suggests opportunities for businesses to sell more to always on and connected consumers.

Consistent with past years’ Outlooks, PwC’s analysis found that not all industry sectors are adapting well to the ‘digital normal’.

Online charges

Newspaper revenues are forecast to drop an average of 4.8% each year over the forecast period as its advertising revenue decreases by 7.3% year-on-year.

Newspaper publishers should be encouraged that digital revenues are growing, but are a long way from being enough to offset the pullback in the country’s print newspaper advertising revenues.

New Zealand newspapers have been slower than their peers in Australia in beginning to charge readers for online content.

The game is, out of New Zealand’s two major newspaper publishers, who will be the first to move in putting up a pay wall to charge for readership, because everyone can see that it is not viable for news to be given away as a free snack for public consumption.

Paul Brabin is Partner and Digital Market Leader at PricewaterhouseCoopers New Zealand, based in Auckland.