The insurance sector will come under tighter supervision making it mandatory for insurers, brokers and others to improve their financial management and accountability, a senior official of the Reserve Bank of New Zealand (RBNZ) has said.

RBNZ Insurance Oversight Manager Peter Brady said in a speech to the delegates attending the ‘Finity Consulting Directors Forum’ held in Auckland on February 19 that the Bank was considering a series of measures to strengthen the performance of the insurance sector.

His speech was read out by the Bank’s Operational Policy Manager Richard Dean.

Robust Legislation

New Zealand’s Parliament passed the ‘Insurance Prudential Supervision Act’ (IPSA) 2010 on September 7, 2010, following which RBNZ introduced a licensing regime for insurers.

New Zealand’s Parliament passed the ‘Insurance Prudential Supervision Act’ (IPSA) 2010 on September 7, 2010, following which RBNZ introduced a licensing regime for insurers.

Mr Brady said that the RBNZ was a ‘gatekeeper’ in the first instance to ensure that only those with suitable qualifications were licensed to conduct insurance business.

“We then put in place minimum prudential standards that licensed insurers must comply with, and monitor and enforce compliance with these standards. RBNZ steps in to help manage insurer distress where and when deemed necessary,” he said.

The Act empowers the Bank to supervise the activities of insurers to achieve public policy goals and compliance at reasonable cost to insurers and taxpayers.

No guarantees

Admitting that IPSA is not a ‘zero-failure regime,’ Mr Brady said that the Act does not require RBNZ to ensure that there were no insurance failures or no loss to policyholders.

There is no guarantee that the Government will support insurers if they come to grief or difficulties, he added.

The Licensing regime has been a strenuous exercise, Mr Brady said.

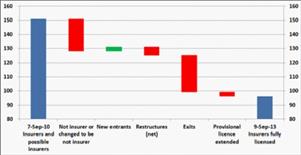

“Insurers have to satisfy 22 matters (such as adequacy of governance and solvency) before a license could be issued. The licensing process took nearly three years and represented a major effort on the part of the insurance industry and RBNZ. It was a significant achievement for all to have completed the process before the legislated deadline of September 7, 2013. The outcome was 96 full licenses issued, and three insurers in run-off continuing on a provisional license,” he said.

During the evaluation process, RBNZ officials found that a number of applicants did not conform to the IPSA definition of insurer, while many others changed the nature of their business and hence breached the borders of the prudential regime.

Philosophical approach

Mr Brady said that since empowered by the Act, the RBNZ had put in place 34 specific regulations, eight standards and 12 guidelines.

The Bank adopts a ‘philosophical approach’ in its regulatory regime, somewhat similar to its role in regulating the banking sector.

Its role is based on Three Pillars, including Self-Discipline, Market Discipline and Risk-based Supervision.

“RBNZ recognises that not all insurers are equally important from a risk perspective and that the supervisor can deliver most value by focusing its resources on the insurers that have the most impact on the economy, and on the risks that pose the greatest threat to the soundness and efficiency of the insurance sector,” Mr Brady said.

Risk-based supervision acknowledges that resources are finite, that there is no unlimited pool of public funding on which to draw, and that the supervisor has to make choices about what it will and will not do.

Mr Brady was forthright in defining the responsibilities of insurers.

“Directors and senior management of insurers can expect that RBNZ will hold them accountable for full compliance with IPSA requirements. Compliance with IPSA is achieved by continuously meeting all of the relevant requirements associated with qualifying for a license,” he said.

RBNZ is developing a structured and systematic tool to assess insurer risks.

For full text of Mr Bradley’s speech, please visit www.rbnz.govt.nz

Read our editorial, ‘Insurers face risk management challenge’ under Viewlink