Globally, for the first time in two years, both the appetite and the capacity to transact are showing signs of improvement.

Globally, for the first time in two years, both the appetite and the capacity to transact are showing signs of improvement.

In the local context, however, there are some subtle differences.

Although the appetite of New Zealand corporates to transact is expected to improve, our capacity levels may remain unchanged.

New Zealand firms appear to be facing less pressure to deleverage, partly due to the relatively healthy banking environment.

The implications of this are not immediately concerning, although we should consider the potential future impact of our relatively high levels of debt. This could threaten earnings if interest rates begin to rise down the track; and affect our competitiveness against overseas buyers with greater debt capacity.

In terms of transaction volume, our Mergers and Acquisition (M&A) market is showing signs of improved deal activity, reflecting the high levels of confidence.

Increasing confidence

After a steady decline in global confidence over the past two years, there are now positive signs of confidence returning for the world’s largest companies.

After a steady decline in global confidence over the past two years, there are now positive signs of confidence returning for the world’s largest companies.

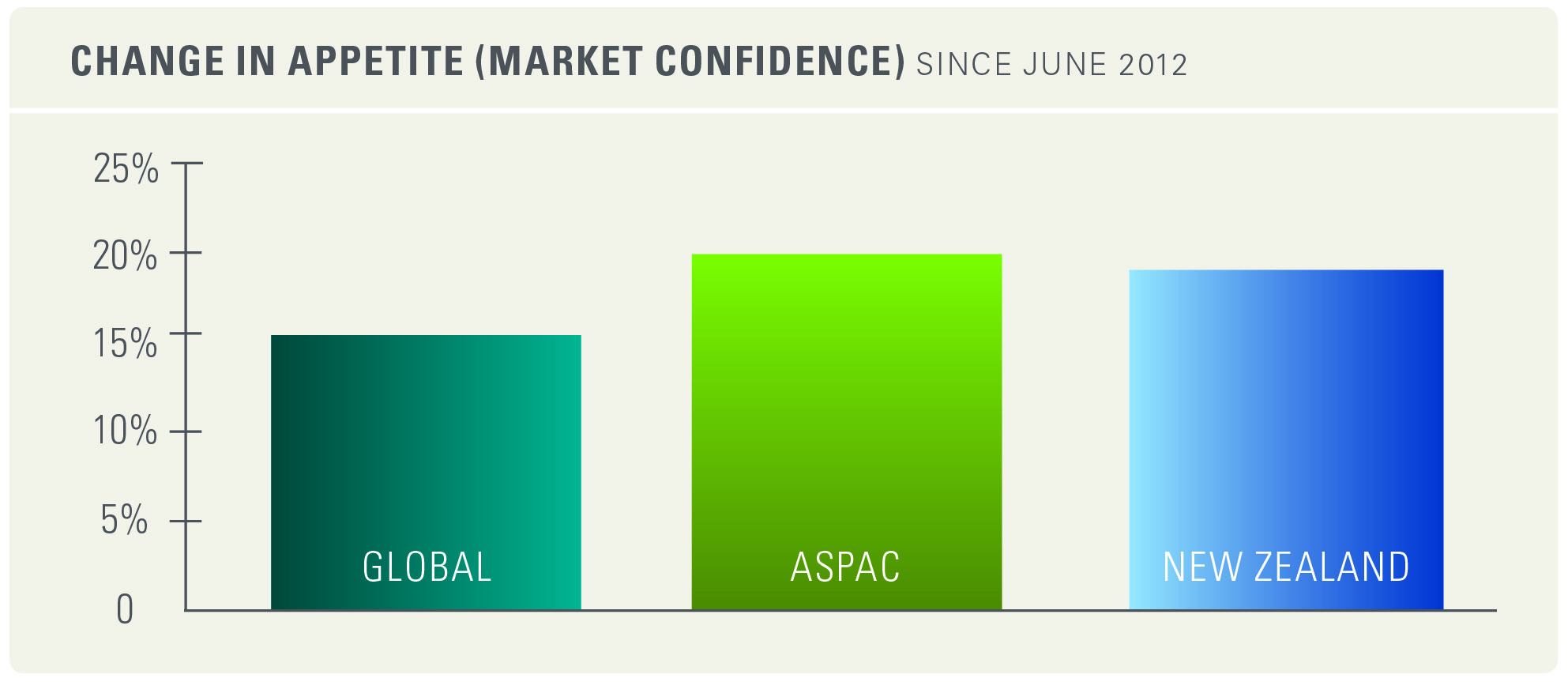

Analyst expectations indicate that appetite to do deals has risen in almost every country covered. Global appetite has increased 12% from a year ago and 15% over the past six months. This reflects the passing of unsettling global macro-economic events such as the Eurozone crisis, US elections, the ‘fiscal cliff’ and the transition in China’s leadership.

During the six months to December 2012, appetite in the Eurozone increased 19%, indicating optimism in the European market.

New Zealand also appears to be faring well, with confidence levels up 19% since June 2012. This is not surprising with the NZX 50 up approximately 20% in 2012, and NZ managed funds recording their highest returns in seven years.

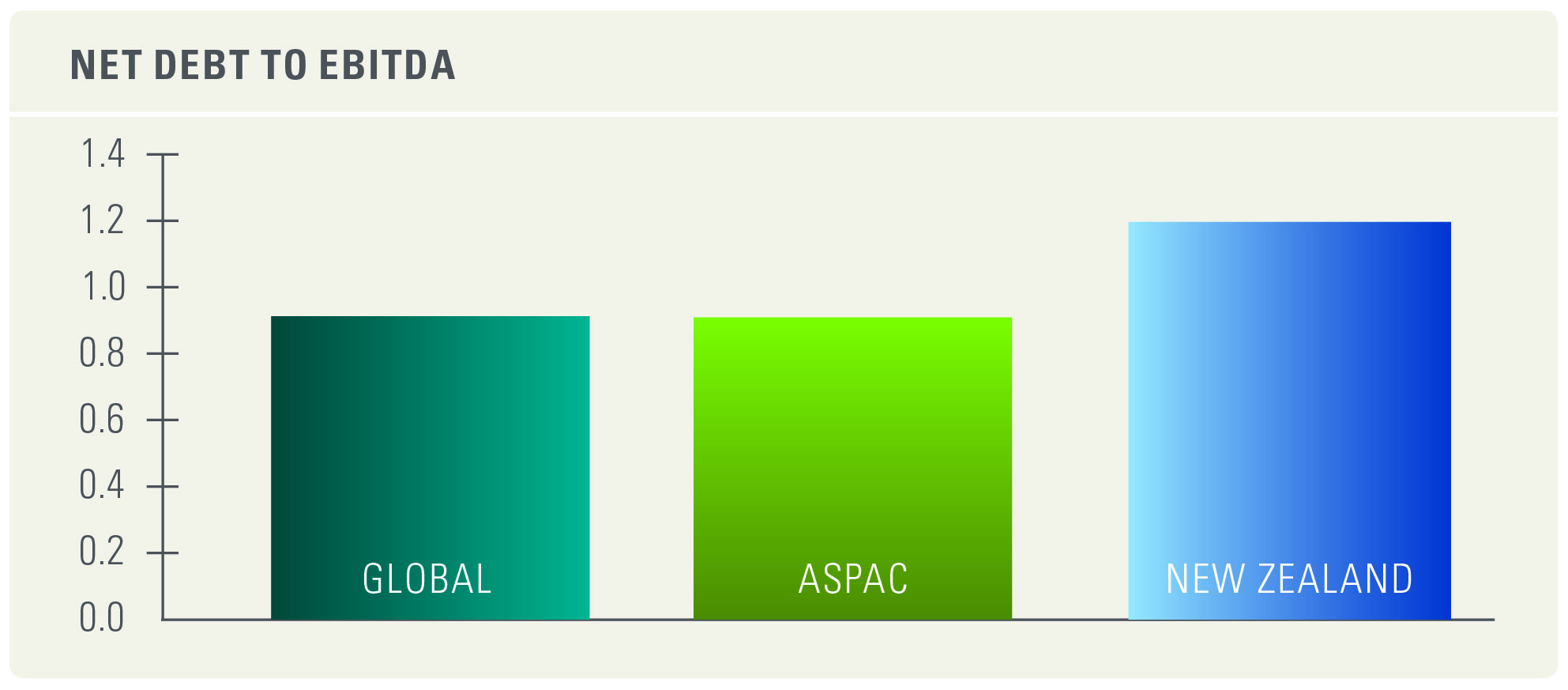

Globally, while net debt to EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortisation) ratios rose slightly in the six months to December 2012, analysts expect these to decrease by 15% over the next 12 months, improving M&A capacity. This is the first time in two years that the ‘Global M&A Predictor’ expects the capacity to transact and the appetite for deals to improve over the same period.

High EBITDA

The net debt to EBITDA ratio among New Zealand’s largest companies is still high. While deleveraging is expected to continue in global and Asia Pacific (ASPAC) companies, analysts do not expect much change among our corporates.

Debt presents an attractive proposition for New Zealand firms while interest rates remain low. The flipside is that high levels of debt may threaten earnings if interest rates begin to rise, and could reduce our ability to do debt-funded deals down the track. However, our market soundings suggest that there is good liquidity in the NZ banking market.

Profit expectations for NZ firms appear to be relatively unchanged, down only 2%.

New Zealand firms may note the declining profit expectations among some of our key trading partners. Australian companies report a drop of 19% and Chinese companies a drop of 10%.

Transaction activity

In the first half of 2012, our deal volumes also dropped, consistent with the global trend. New Zealand deal values settled back at the US$5 billion to US$7 billion mark, down from around US$13b for the first half of 2012.

This is despite the fact that a number of high profile, larger deals took place in late 2012, such as Haier/Fisher & Paykel and Vodafone/Telstra. While total deal numbers are stabilising, fewer large deals can impact trailing deal values significantly

The above is the first part of detailed analysis of Mergers and Acquisitions, prepared by Tony McNaught, Head of Mergers and Acquisitions at KPMG New Zealand. The second and concluding part will appear in our next issue. KPMG is the Sponsor of the ‘Business Excellence in ICT’ Category of the Indian Newslink Indian Business Awards 2013.

Graphs by KPMG