Our aim is a long period of steady growth delivering pay rises and more jobs every year, rather than a shorter period of unsustainable growth.

Our aim is a long period of steady growth delivering pay rises and more jobs every year, rather than a shorter period of unsustainable growth.

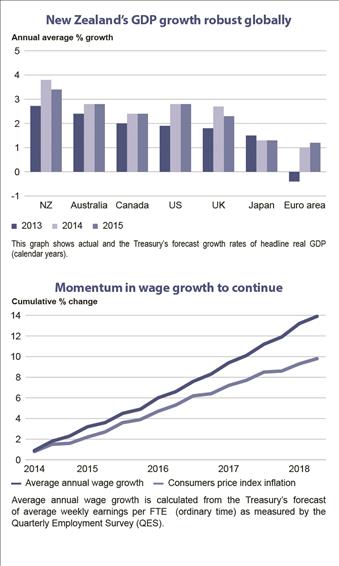

Over the past year, 84,000 more people have jobs.

Average weekly wages have gone up by 3.2%, while inflation has been just 1.5%

This momentum is forecast to continue for the next four years.

Our challenge is to lock in these hard-won gains; to assemble the capital, the people and the skills to take advantage of our improving prospects to secure a brighter future for New Zealand families.

The Government has a clear plan based around its four key priorities namely 1 Responsibly manage the Government’s finances 2. Build a more productive and competitive economy 3. Deliver better public services and 4. Rebuild Christchurch

Finance Management

The Budget confirms that the Government is on track to achieve its surplus and debt targets. New spending of $5.7 billion over the current year and the next four is financed in part by $1.6 billion of reprioritisation and revenue raising initiatives.

Tax revenue has increased as the economy has recovered. But the fiscal turnaround has been achieved largely by expenditure restraint that targets value and results.

Over the next four years, the Government will continue to focus on achieving better results as the main way of restraining future government expenditure.

The improving fiscal outlook means that there is room to increase future operating allowances while remaining on track to reduce debt to 20% in 2019-2020.

Operating allowances from Budget 2015 will be $1.5 billion a year, growing at 2% for Budgets thereafter. This moderate increase will provide the Government with options around investment in public services and modest tax reductions.

The Treasury advises this will not materially affect interest rates.

These allowances are well below those adopted in the mid-2000s.

This means lower interest rate rises, less pressure on households with debt, more investment in productive business and less pressure on the exchange rate for our exporters.

Longer-term projections show net debt dropping to 20% of GDP in 2019-2020, in line with the Government’s target. This includes the impact of resuming full contributions to the New Zealand Superannuation Fund in 2019-2020.

Competitive Economy

Looking ahead, there are significant opportunities for New Zealand as countries in the Asia-Pacific region develop  rapidly and demand more of what we produce.

rapidly and demand more of what we produce.

The Government’s Business Growth Agenda sets out a wide-ranging programme of micro-economic reforms to help businesses perform well, particularly in the tradable and export sectors. New initiatives and policies to boost economic performance include $375 million loan to the New Zealand Transport Agency to kick-start Auckland Transport projects valued at $815 million to reduce congestion in the City.

The Government has also proposed to provide an additional $69 million over the next four years to New Zealand Trade & Enterprise and an additional $57 million over the next years for Contestable Science Funding.

Among the other initiatives are $58 million in increased tax deductions for R&D by start-up firms and 6000 extra places in Apprenticeship Reboot.

Public Services

The Budget provides significant extra support for families and young children who most need our care and protection.

Among the initiatives are (a) $500 million package to support families (b) $172 million to extend paid parental leave; additional four weeks, starting with a two-week extension from April 1, 2015 and another two weeks from April 1, 2016 (c) Extend eligibility of paid parental leave to caregivers other than parents (for example, Home for Life caregivers) and to extend parental leave payments to people in less-regular jobs or who recently changed jobs (d) $42 million to increase the parental tax credit from $150 a week to $220 a week and increase the payment period from eight to 10 weeks from April 1, 2015 (e) $90 million to provide free GP visits and prescriptions for children aged under 13, starting on July 1, 2015 and (f) $156 million to help early childhood centres remain affordable and increase participation towards the Government’s 98% target.

Rebuilding Christchurch

Since the first earthquake in September 2010, the Government has backed Cantabrians in the initial response, and now in the recovery and the rebuild.

The total cost of the rebuild has been estimated at $40 billion and the Government’s share will be significant.

On current estimates, the Government’s contribution to the rebuild is expected to be $15.4 billion, of which $7.3 billion will be incurred by the Earthquake Commission (EQC) net of reinsurance proceeds.

The Government is paying an estimated $9 million every working day in rebuild invoices; 53,000 home repairs have been completed by EQC.

Horizontal infrastructure repairs in the central city are on track to be 90% complete by the end of the year.

Our $1 billion Education Renewal Programme is delivering new and rebuilt classrooms across the city.

The Government has taken decisions on anchor projects, enabling tendering for them to start. Physical rebuilding has started on the redevelopment of the Avon River Precinct and East Frame.

Bill English is Deputy Prime Minister and Finance Minister of New Zealand. The above is an extract of his Executive Summary while introducing the Government’s Budget to Parliament on May 15, 2014. For full text of his Speech and budget proposals, please visit www.treasury.govt.nz

Specialist comments appear under our Budget Special in Businesslink.

Source: The Treasury